45+ Straight Line Method Of Depreciation Calculator

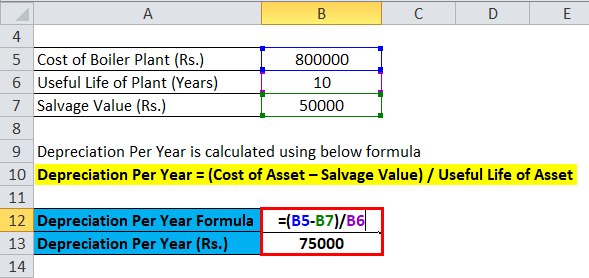

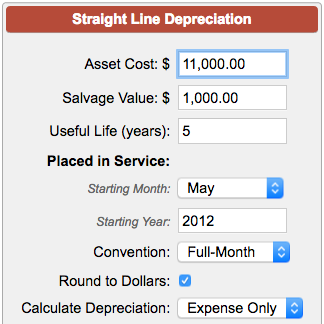

Web The straight line depreciation for the machine would be calculated as follows. Web To use this simple depreciation calculator you need two values.

Straight Line Depreciation Formula Calculator Excel Template

Web To find the yearly depreciation amount using the double-declining method multiply the value of the asset at the beginning of the year by twice the straight line.

. Web How do you calculate straight line depreciation. In year one you multiply the cost or beginning book value by 50. Lets take an asset which is worth 10000.

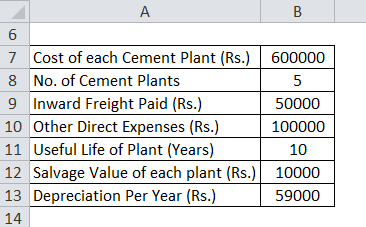

Purchase or acquisition price of the asset - estimated salvage value of asset useful life of asset. Depreciation expense 4500-1000 5 700. According to accounting best practices the.

Web Annual straight line depreciation of the asset will be calculated as follows. The following is the formula. If you want to calculate using the straight line depreciation method use the straight line depreciation formula.

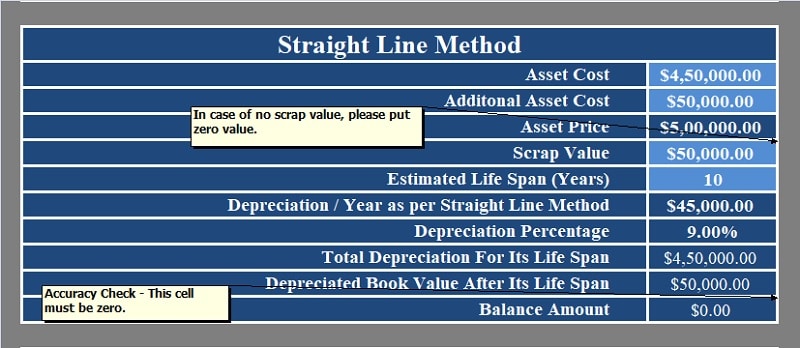

Web December 20 2022. Straight line depreciation is a common method of depreciation where the value of a fixed asset is reduced over its useful life. Web To determine straight-line depreciation for the MacBook you have to calculate the following.

This is the first years depreciation deduction. Then multiply the one-year depreciation value by 2. Web Straight-line depreciation is the most widely used and simplest method.

It is a method of distributing the cost evenly across the useful life of the asset. Straight-line depreciation with a finance lease. Web The DDB rate of depreciation is twice the straight-line method.

Web First find the yearly straight line depreciation value as explained above. Web Straight Line Depreciation Calculator When the value of an asset drops at a set rate over time it is known as straight line depreciation. Web How to Calculate the Straight Line Basis.

Historical Cost of Goods and number of years to deprecaite over. Now lets consider a full example of finance lease accounting to illustrate straight-line depreciation. Here 700 is an annual depreciation expense.

Web The straight line depreciation method requires only that you determine the useful life of the asset estimate salvage value and calculate annual or even monthly. 100000 Cost of the asset Estimated salvage value. Annual depreciation 2000 - 500 5 years 1500 5.

Companies use the straight line basis method to determine the amount to be expensed over accounting periods. Web The formula for calculating straight-line depreciation is as follows. Cost of the asset.

1 Free Straight Line Depreciation Calculator Embroker

Straight Line Depreciation Calculator Free Calculator Tool

Depreciation Calculator

Straight Line Depreciation Calculator Free Calculator Tool

Straight Line Depreciation Calculator 100 Free Calculators Io

30 Best Business Accountants In Melbourne Victoria 2023

Straight Line Depreciation Formula Calculator Excel Template

What Is Straight Line Depreciation Definition Formula Accounting Entries Exceldatapro

How Much Does It Cost To Own A Car Quora

4 Steps To Calculate Depreciation Using The Straight Line Method Youtube

Shift4 Payments Inc General Corporate Statement Form8 Shift4 Payments Nyse Four Benzinga

Numerology Calculator Online Solver With Free Steps

Straight Line Depreciation Calculator

1 Free Straight Line Depreciation Calculator Embroker

Accounting Finance Excel Google Sheets Templates

Writing Covered Call Options To Compensate For Share Depreciation The Blue Collar Investor

Accounting Finance Excel Google Sheets Templates